The eInvoice portal is a digital platform developed by the Government of India to facilitate the generation and management of electronic invoices for businesses. It streamlines the process of issuing invoices under the Goods and Services Tax (GST) regime, ensuring compliance with GST laws.

The e invoice portal allows businesses to create, validate, and store eInvoices in a standardized format, which is then automatically shared with the GST and eWay Bill systems. This integration reduces manual data entry, minimizes errors, and enhances transparency in transactions. The eInvoice portal is a crucial tool for businesses to maintain accurate and efficient tax records.

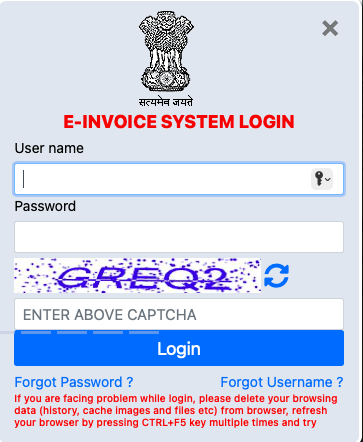

eInvoice Portal Login

Here are the steps for login on the e-Invoice Portal:

STEP 1: Visit Good and Services Tax e-invoice official portal einvoice1.gst.gov.in.

STEP 2: On the homepage, click on the “Login” button at the top-right corner.

STEP 3: Enter User Name and Password.

STEP 4: Fill in the CAPTCHA code displayed on the screen and click on “Login” button.

STEP 5: Once logged in, you can generate, manage, and view your e-Invoices as needed.

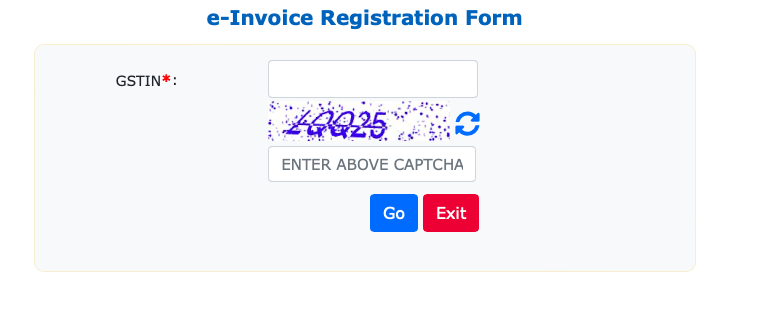

e-Invoice Registration Form

Here are the steps for completing the e-Invoice Registration Form

STEP 1: Visit official website of Goods & Services Tax e Invoice System einvoice1.gst.gov.in.

STEP 2: On the homepage, find the “Registration” option in the menu.

STEP 3: Direct link https://einvoice1.gst.gov.in/Home/UserRegistration.

STEP 4: Enter your GSTIN (Goods and Services Tax Identification Number) and the CAPTCHA code.

STEP 5: Click on the “Go” button to proceed to the next step.

STEP 6: Verify the auto-populated details related to your business. Ensure that all information is correct.

STEP 7: Provide any additional details required in the form, such as contact information and business type.

STEP 8: Create your username and password for future logins to the e-Invoice portal.

STEP 9: Review all the entered information and click on the “Submit” button to complete the registration process.

e Invoice Portal API

The e-Invoice Portal API is a powerful tool provided by the Government of India to facilitate seamless integration between a business’s accounting or ERP systems and the e-Invoice system under the Goods and Services Tax (GST) regime.

The API (Application Programming Interface) allows businesses to automate the process of generating, validating, and managing e-Invoices directly from their internal systems, without needing to manually access the e-Invoice portal.

Key Features of e-Invoice Portal API

- Invoice Generation: Businesses can generate e-Invoices in real-time, ensuring that each invoice is compliant with GST regulations.

- Validation and IRN Generation: The API allows the real-time validation of invoices and generates a unique Invoice Reference Number (IRN) for each invoice.

- QR Code Generation: The API also facilitates the creation of a QR code, which contains critical invoice information for easy verification.

- Seamless Integration: It integrates smoothly with existing ERP systems like SAP, Tally, Oracle, and others, reducing manual entry and errors.

- Data Security: The API ensures that all data exchanges between the business and the government’s e-Invoice system are secure and encrypted.

- Automated Data Flow: It enables the automatic transfer of e-Invoice data to the GST portal and the eWay Bill system, ensuring compliance without additional effort.

- Scalability: Designed to handle a large volume of transactions, the API is scalable, making it suitable for businesses of all sizes.

For details of eInvoice portal API visit official website https://einv-apisandbox.nic.in/apicredentials.html