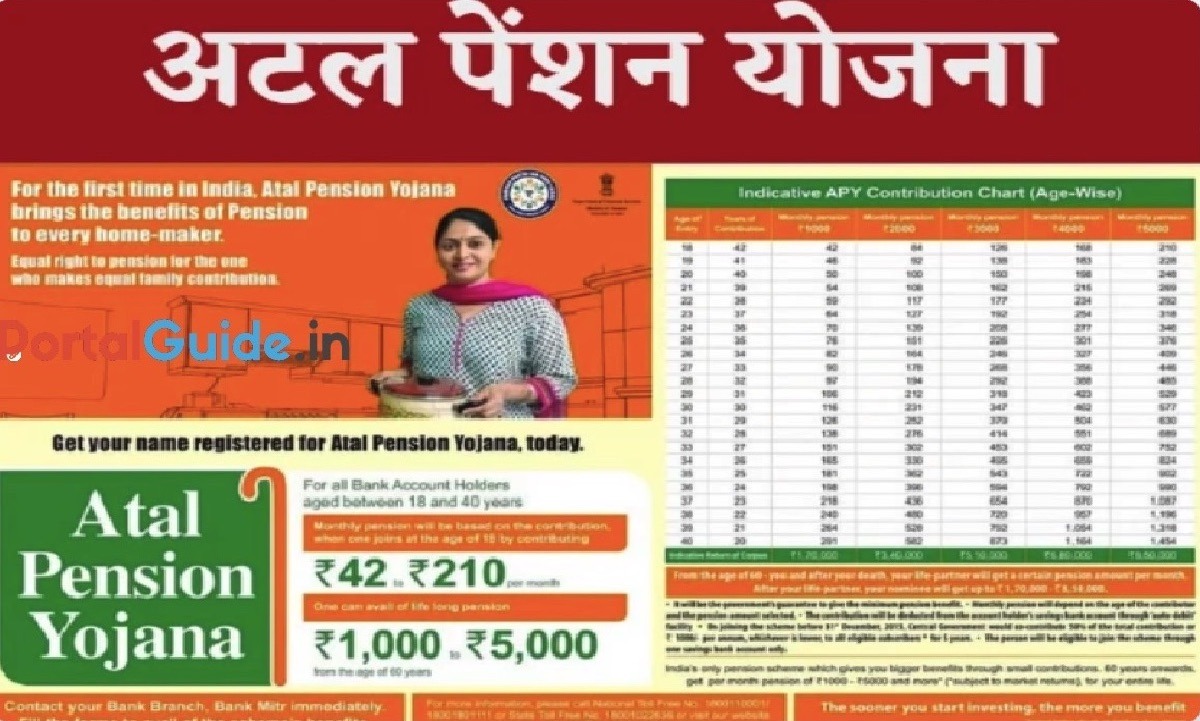

Atal Pension Yojana is a pension scheme for people in India, especially those who work in the unorganized sector. Under APY, you can get a guaranteed pension of Rs. 1,000, 2,000, 3,000, 4,000, or 5,000 per month when you turn 60. The amount depends on how much you contribute. Any Indian citizen can join the APY scheme.

Atal Pension Yojana Overview

| Scheme Name | Atal Pension Yojana (APY) |

| Launched By | Govt. of India |

| Minimum Pension | Rs. 1000 |

| Age of Subscriber | 18-40 Years |

| Official Website | https://www.india.gov.in/ |

https://portalguide.in/eshram-card-registration/

Eligibility for APY Scheme

There are following eligibility criteria for APY Scheme

- Any Indian citizen can join the APY scheme

- The subscriber should be between 18 and 40 years old

- They should have a savings bank account or a post office savings account.

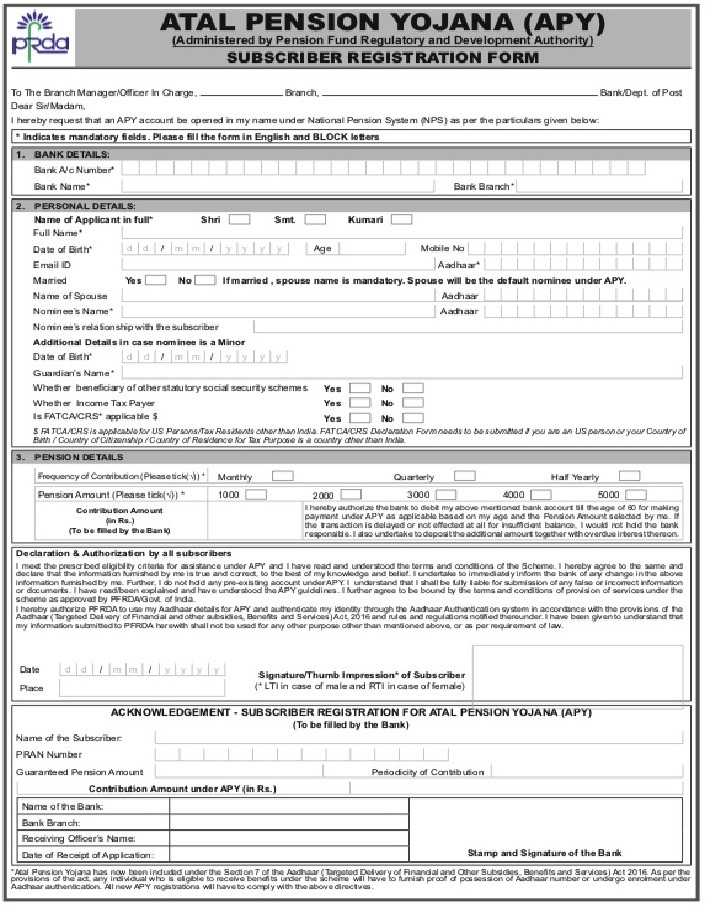

Atal Pension Yojana Registration Form

Download registration for Atal Pension Yojana (APY) from below link.

https://npscra.nsdl.co.in/nsdl/forms/APY_Subscriber_Registration_Form.pdf

APY Account Opening Procedure

There are following steps to open an Atal Pension Yojana account

STEP 1: Go to the bank branch or post office where you have a savings account. If you don’t have a savings account, open one there.

STEP 2: Give your bank account number or post office savings account number to the bank staff, and they will help you fill out the APY registration form.

STEP 3: Provide your Aadhaar number or mobile number. This isn’t required, but it can help with communication about your contributions.

STEP 4: Make sure you have enough money in your savings account or post office savings account for the monthly, quarterly, or half-yearly payments.

Atal Pension Yojana Benefits

The government guarantees a minimum pension under the Atal Pension Yojana.

- If the actual returns on pension contributions are less than the assumed returns for the minimum guaranteed pension, the government will cover the shortfall.

- If the actual returns are higher than the assumed returns, the excess will be credited to the subscriber’s account, increasing the benefits.

The government will co-contribute 50% of the total contribution or Rs. 1000 per year, whichever is lower, for each eligible subscriber.

- This applies to subscribers who join the scheme from June 1, 2015, to March 31, 2016.

- The subscriber must not be a beneficiary of any social security scheme and must not be an income tax payer.

- The government co-contribution will be provided for 5 years, from the financial year 2015-16 to 2019-20.

Subscribers under the National Pension System (NPS) are eligible for tax benefits on their contributions, investment returns, and annuity purchase price upon exit.

- Only the pension income is taxed as part of normal income at the appropriate marginal rate.

- Similar tax benefits apply to subscribers of the Atal Pension Yojana (APY).

APY Withdrawal Procedure

On Attaining age of 60:- When subscribers turn 60, they should request their bank to start the monthly pension. If the investment returns are higher than expected, they will get a higher pension. After the subscriber’s death, their spouse (the default nominee) will receive the same monthly pension. If both the subscriber and spouse pass away, the nominee will get the accumulated pension wealth.

In Case of Death of the Subscriber:- If the subscriber dies, the spouse will receive the same pension. If both the subscriber and the spouse die, the nominee will get the accumulated pension wealth.

Exit before the Age of 60:- If a subscriber with government co-contribution under APY decides to leave the scheme, they will only get back their own contributions and the income earned on them (after deducting account maintenance charges). The government’s contributions and the income earned on those will not be returned.

Death of Subscriber before Age of 60:- If the subscriber dies before turning 60, the spouse can choose to continue contributing to the APY account in their own name until the subscriber would have turned 60. The spouse will receive the same pension amount as the subscriber after that.