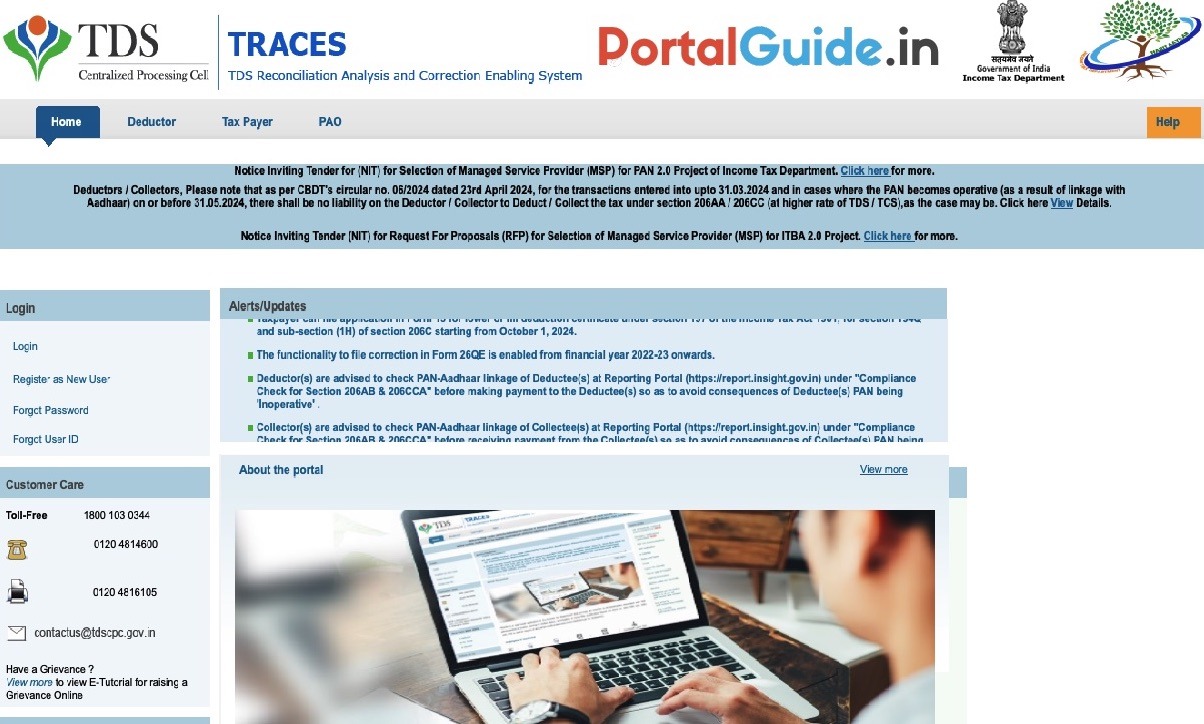

The TRACES portal is an online platform developed by the Income Tax Department of India for managing Tax Deducted at Source (TDS) and Tax Collected at Source (TCS). It facilitates a wide range of services for taxpayers, deductors, and collectors, ensuring smooth TDS/TCS compliance.

About TRACES Portal

The TRACES (TDS Reconciliation Analysis and Correction Enabling System) portal is an online platform developed by the Income Tax Department of India, offering a comprehensive interface for all stakeholders involved in TDS (Tax Deducted at Source) administration.

It allows users to check the status of challans, download important documents such as the Conso File, Justification Report, and various forms like 16, 16A, 16B, 16C, 16D, 16E, and 27D. Additionally, the portal provides access to annual tax credit statements (Form 26AS/Annual Tax Statement), ensuring transparency and ease in TDS compliance.

Key Features of the TRACES Portal

- Challan Status Check: Users can view the status of their tax payments and challans.

- Form Downloads: Allows downloading of various TDS/TCS certificates like Form 16, 16A, 16B, 16C, 16D, 16E, and 27D.

- Consolidated (Conso) File: Enables downloading of the Conso File, which contains all TDS returns filed by deductors.

- Justification Report: Provides detailed explanations of defaults or errors identified by the Income Tax Department in TDS returns.

- Form 26AS: Facilitates viewing and downloading of the Annual Tax Credit Statement (Form 26AS), which reflects tax credits available to taxpayers.

- Correction of TDS Returns: Users can file correction statements and rectify any mistakes in TDS returns.

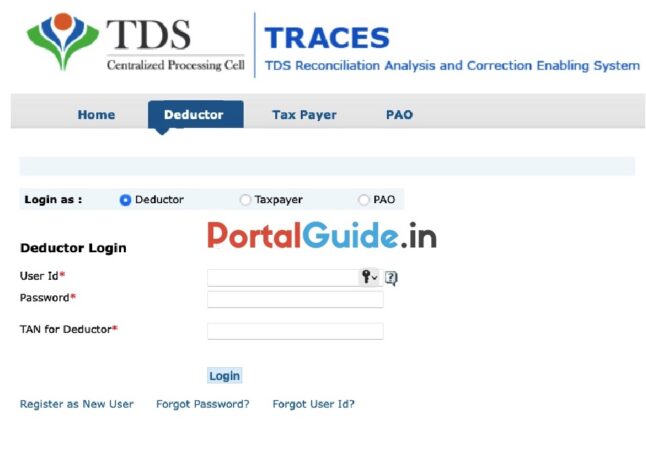

TRACES Portal Login

Here are the steps to log in to the tdscpc.gov.in portal:

STEP 1: Visit TDS Centralized Processing Cell official website https://contents.tdscpc.gov.in

STEP 2: Click on the “Login” option available on the homepage.

STEP 3: Select the option Login as Deductor, Taxpayer or PAO.

STEP 4: Enter User Id and Password.

STEP 5: If logging in as a Deductor, please enter your TAN (Tax Deduction and Collection Account Number).

STEP 6: If logging in as a Taxpayer, please enter your PAN (Permanent Account Number).

STEP 7: If logging in as a PAO, please enter your AIN (Account Information Number).

STEP 8: Now click the “Login” button to access your account.

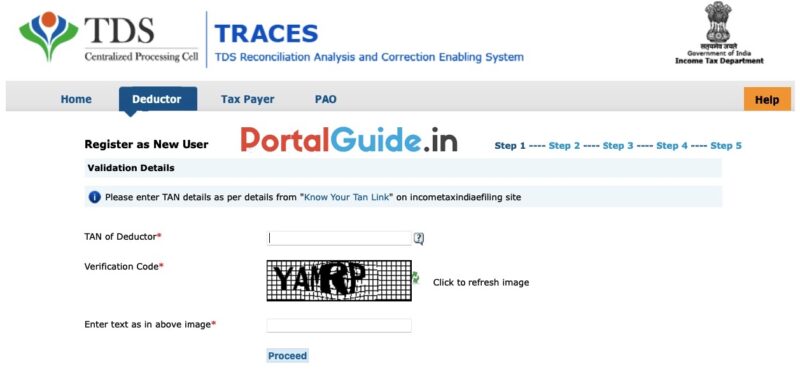

TRACES Registration 2024

The following steps outline the registration process at the TRACES portal:

STEP 1: Visit the TRACES official website https://contents.tdscpc.gov.in.

STEP 2: On the homepage, click on “Register as New User” link.

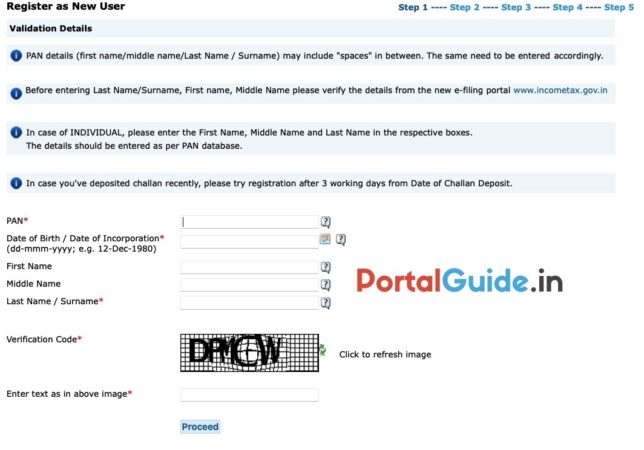

STEP 3: Choose User Type (Deductor, Taxpayer, or PAO) based on your role.

STEP 4: Fill in the details such as TAN (for Deductor), PAN (for Taxpayer), or AIN (for PAO).

STEP 5: Enter valid contact details.

STEP 6: Set a secure password for your account.

STEP 7: You will receive an OTP on your registered mobile number or email address. Enter the OTP to complete verification.

STEP 8: After filling in all the required information and verifying your details, submit the form to complete the registration process.

https://portalguide.in/category/central-government/

Functionalities for Tax Payers through TRACES

The Annual Tax Statement available on the TRACES portal for Assessment Year 2023-24 onwards will include the following information:

- Details of Tax Deducted at Source (TDS)

- Details of Tax Deducted at Source for Form 15G/15H submissions

- Details of transactions under the Proviso to section 194B/First Proviso to sub-section (1) of section 194R/Proviso to sub-section (1) of section 194S

- TDS details under sections 194IA, 194IB, 194M, and 194S (applicable to the seller/landlord of property, contractors, professionals, and sellers of virtual digital assets)

- Transaction details under Proviso to sub-section (1) of section 194S as per Form-26QE (for sellers of virtual digital assets)

- Details of Tax Collected at Source (TCS)

- TDS details under sections 194IA, 194IB, 194M, and 194S (applicable to buyers/tenants of property or persons making payments to contractors, professionals, or buyers of virtual digital assets)

- Transaction and demand payment details under Proviso to sub-section (1) of section 194S as per Form-26QE (for buyers of virtual digital assets)

- Information on TDS/TCS defaults

- Information on TDS/TCS refunds

Helpline

Contact Information:

- Toll-Free: 1800 103 0344

- Telephone: 0120 4814600

- Fax: 0120 4816105

- E-mail: [email protected]