The e-Filing portal is an online platform that allows taxpayers to file their income tax returns, track refunds, and manage tax-related activities efficiently. It offers a user-friendly interface, ensuring a seamless experience for individuals and businesses to comply with tax obligations, access forms, and view transaction history securely.

eFiling Portal Income Tax

The e-Filing Portal for Income Tax is a comprehensive online platform provided by the Income Tax Department of India, enabling taxpayers to file their income tax returns, pay taxes, and access various tax-related services. The portal simplifies the process of tax filing by offering a user-friendly interface and step-by-step guidance.

It also allows users to track refunds, view past filings, and check their tax credit statement (Form 26AS). With features like e-verification, instant acknowledgment of returns, and secure data management, the e-Filing portal enhances transparency and efficiency, making it easier for taxpayers to comply with their tax obligations.

eFiling Portal Login

Here are the steps to log at e-Filing Portal.

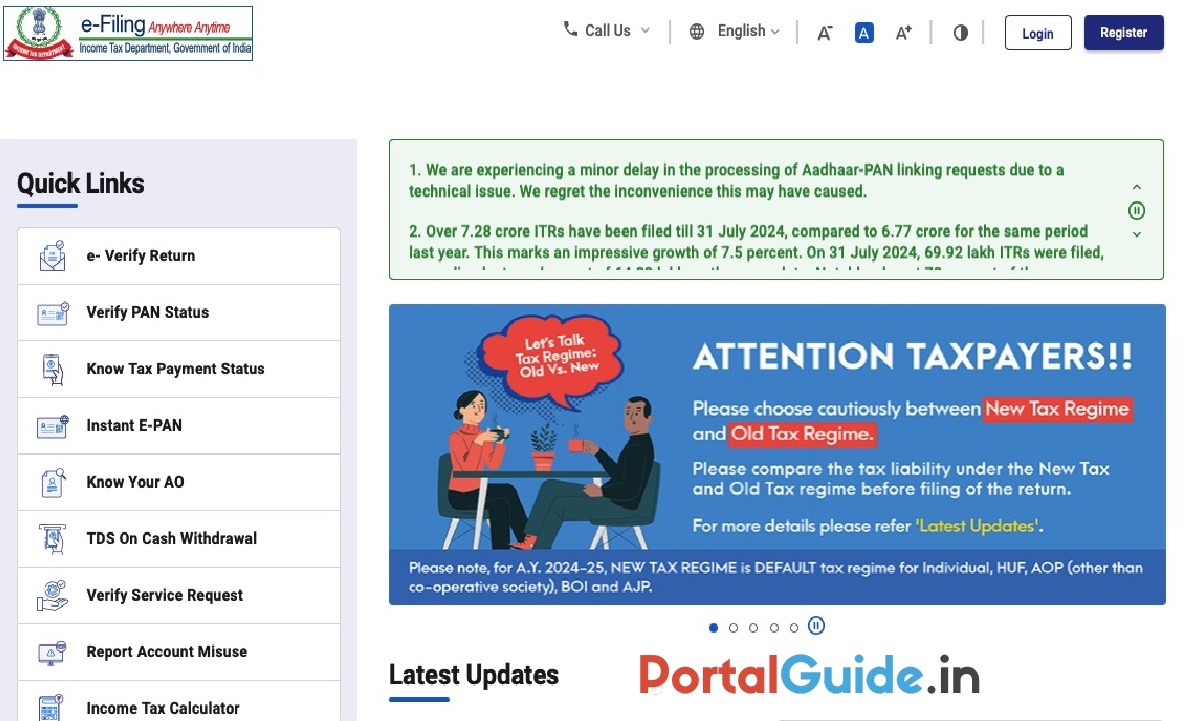

STEP 1: Visit e-Filing Income Tax Department official website incometax.gov.in

STEP 2: On the homepage, click at ‘Login’ button on the top-right corner.

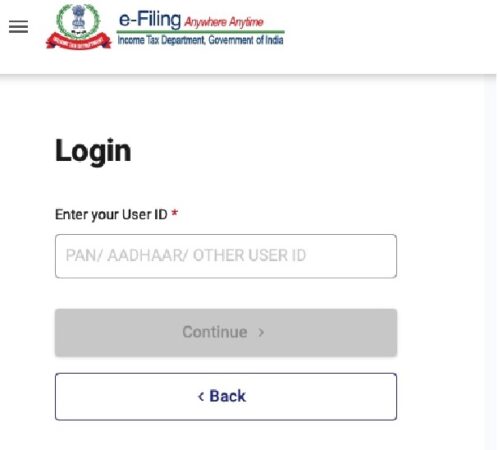

STEP 3: Direct link https://eportal.incometax.gov.in/iec/foservices/#/login

STEP 4: Enter your User ID PAN/Aadhaar/Other User ID and click on “Continue” button.

STEP 5: Enter your password and solve the captcha code. Then, click ‘Login.’

STEP 6: Once logged in, you will be redirected to your account dashboard, where you can access various e-filing services.

How to Access the e-filing Tax Portal

To access the services provided by the e-filing portal, taxpayers must first register on the platform. A step-by-step guide for the registration process is outlined below:

STEP 1: Visit eFiling income tax official portal incometax.gov.in/iec/foportal/

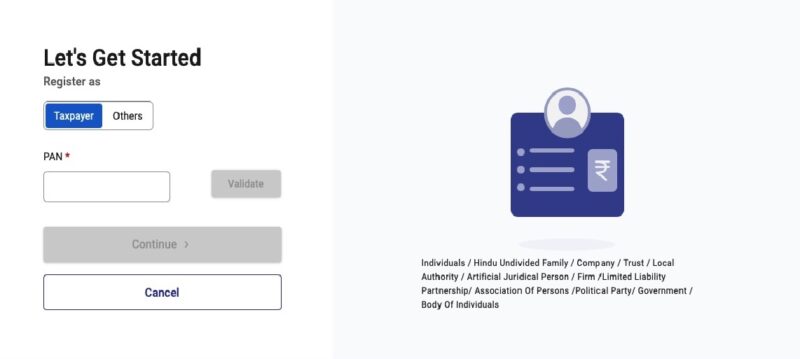

STEP 2: On the homepage, click at ‘Register’ button on the top-right corner.

STEP 3: Direct link https://eportal.incometax.gov.in/iec/foservices/#/pre-login/register.

STEP 4: Select user type Taxpayer or Others, enter PAN number and click “Continue” button.

STEP 5: A “Basic Detail Page” will be displayed. Enter all the required details, such as name, date of birth/incorporation, gender (if applicable), and residential status as per your PAN. After completing these fields, click on “Continue.”

STEP 6: Once your PAN is validated, the “Contact Details” page will appear for individual taxpayers. Enter your contact information, including your primary mobile number, email ID, and address. Then, click “Continue.”

STEP 7: On the “Set Password” page, enter your desired password in both the “Set Password” and “Confirm Password” fields. Then, input a personalized message and click “Register.”

STEP 8: A confirmation message indicating successful registration will appear on the portal. Once registration is complete, click “Proceed to Login” to start the login process.

Common Income Tax Filing Mistakes to Avoid

When filing a tax return, vigilance is crucial as even a small error can lead to complications. To help avoid these issues, we’ve outlined some common mistakes that taxpayers often make.

- Choosing the Wrong ITR Form: A frequent error when filing an Income Tax Return (ITR) is selecting the wrong form. Using an incorrect form results in a defective submission, which the tax department will reject. The choice of ITR form depends on income sources and taxpayer category. For example, ITR-1 is for resident individuals with income up to Rs. 50 lakh, including salaried individuals with one house property and other sources of income. Conversely, those with income exceeding Rs. 50 lakh or earning from both salary and capital gains must use ITR-2.

- Failure to Reconcile TDS with Form 26AS: Before filing your tax return, it’s crucial to review Form 26AS. This form provides a summary of income, TDS deductions, advance tax, and self-assessment tax paid. If TDS is missing from Form 26AS, you might not receive the appropriate tax credit. It’s the taxpayer’s responsibility to ensure that Form 26AS is accurate and up-to-date. Discrepancies between Form 26AS and Form 16 or TDS certificates can result in reduced refunds or additional taxes owed.

- Non-Reporting of Capital Gains from Asset Sales: The ITR requires detailed information on the sale of capital assets, including associated expenses and purchase details, to accurately calculate capital gains. Taxpayers must also disclose investments made to claim capital gains exemptions, along with relevant facts about these investments.

- Non-Disclosure of Foreign Assets: Taxpayers must report all foreign assets owned or beneficially owned in their name. Failure to disclose such assets can result in substantial penalties under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015.

- Filing ITR Without Considering All Income Sources: When filing your tax return, it is crucial to include all sources of income, including those from current or previous employment. Failing to report income from previous jobs can create discrepancies in Form 26AS and TDS certificates. Additionally, ensure that the data in the AIS/Taxpayer Information Summary (TIS) aligns with your records. Any inconsistencies may prompt the tax department to issue a demand notice, potentially leading to additional tax liabilities.