The Mahila Samman Savings Certificate (MSSC) scheme was launched by the Department of Economic Affairs, Ministry of Finance, to provide financial security and encourage savings among girls and women in India. As per an e-gazette notification issued on June 27, 2023, the scheme has been extended to all Public Sector Banks and eligible Private Sector Banks to enhance accessibility.

Initially operational through Post Offices since April 1, 2023, the scheme is now available for subscription at both Post Offices and eligible Scheduled Banks. It is valid for a two-year period ending on March 31, 2025.

About Mahila Samman Saving Certificate Scheme

The Mahila Samman Savings Certificate (MSSC) is a government-backed savings scheme launched by the Department of Economic Affairs under the Ministry of Finance. It is designed to promote financial security and encourage savings among women and girls in India. The scheme provides an attractive, secure, and flexible investment option, empowering women with better financial independence.

SHe Box Portal for Women’s Safety – Workplace Harassment Complaints and Status at shebox.wcd.gov.in

Key Features of Mahila Samman Saving Scheme 2025

- Attractive Interest Rate:

- Deposits earn 7.5% annual interest, compounded quarterly, providing lucrative returns.

- Tenure and Deposit Limits:

- The scheme has a 2-year tenure from the account opening date.

- Minimum deposit: ₹1,000.

- Maximum deposit: ₹2,00,000, in multiples of ₹100.

- Partial Withdrawal Flexibility:

- Account holders can withdraw up to 40% of the balance during the scheme’s tenure.

- Secure and Inclusive:

- Offers women and girls a safe and reliable investment option.

- Encourages savings culture and financial empowerment among women.

- Eligibility:

- Open to all women and girls in India.

Objective of Scheme

- Encourage financial planning among women.

- Bridge the gap in financial inclusion by providing a tailored investment solution.

- Offer a safe and rewarding savings option for women across India.

How It Works

- Women can open an MSSC account at a participating bank or Post Office.

- Deposits under the scheme earn a high-interest rate, offering financial benefits after the two-year tenure.

- Partial withdrawals provide liquidity for emergencies or other requirements during the tenure.

Eligibility for Scheme

- Applicants must be Indian citizens.

- The scheme is exclusively designed for women and girl children.

- Any individual woman is eligible to apply under the scheme.

- Guardians can open accounts on behalf of minors.

- Women of all ages can benefit from this scheme, as there is no upper age limit.

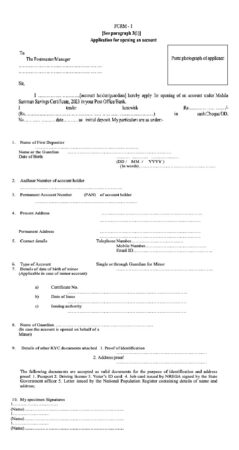

Documents Required to Apply for Mahila Samman Saving Certificate 2025

- Passport size photograph

- Proof of age, i.e., Birth Certificate

- Aadhaar Card

- PAN Card

- Pay-in-Slip along with deposit amount or cheque

- The following documents are accepted as valid for identification and address proof:

- Passport

- Driving license

- Voter’s ID card

- Job card issued by NREGA signed by the State Government officer

- Letter issued by the National Population Register containing details of name and address

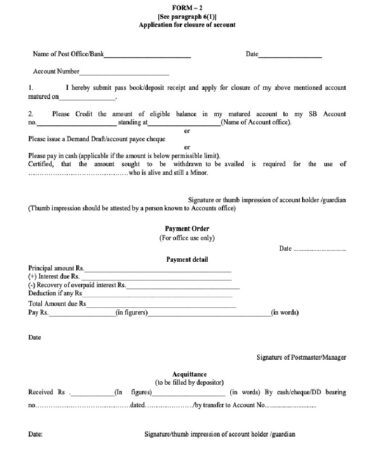

Mahila Samman Saving Certificate Application Process How to Apply

Process to apply for Mahila Samman Saving certificate scheme application is given below step by step:

STEP 1: Visit the nearest Post Office branch or a designated bank.

STEP 2: Obtain the application form from the branch or download it from the official website https://www.indiapost.gov.in/VAS/DOP_PDFFiles/MSSC/Mahila_Samman_Savings_Certificate_2023_English.pdf.

STEP 3: Complete the application form and attach all necessary documents.

STEP 4: Provide the declaration and nomination details as required.

STEP 5: Submit the filled application form along with the initial deposit amount.

STEP 6: Receive the certificate as proof of your investment in the Mahila Samman Savings Certificate scheme.