The Senior Citizen Savings Scheme (SCSS) is a government-backed savings program designed to provide a secure and regular source of income to senior citizens and retired individuals. It combines attractive interest rates, tax benefits, and flexible account management to cater specifically to the financial needs of retirees.

About Senior Citizen Savings Scheme (SCSS) 2025

The Senior Citizens Savings Scheme (SCSS) is a government-supported savings initiative designed for individuals aged 60 and above. It offers an attractive quarterly interest rate of 8.20% with a minimum deposit requirement of ₹1,000 and a maximum limit of ₹30 lakh.

The scheme has a maturity period of 5 years, which can be extended by an additional 3 years. SCSS provides a reliable source of regular income, tax benefits under applicable laws, and the flexibility of premature withdrawals under specific conditions.

Key Features of SCSS

- Deposit Limits:

- Minimum deposit: ₹1,000.

- Maximum deposit: ₹30 lakh (in multiples of ₹1,000).

- Interest Rate:

- Currently offers an attractive interest rate of 8.20% per annum, payable quarterly.

- Interest payments are credited on the 1st working day of April, July, October, and January.

- Tenure and Maturity:

- The scheme has a tenure of 5 years, extendable by 3 additional years upon request.

- Account Management:

- Accounts can be opened individually or jointly with a spouse.

- Premature closure is allowed, subject to conditions.

- Tax Benefits:

- Deposits qualify for tax deductions under Section 80C of the Income Tax Act.

- However, interest earned is fully taxable.

- Accessibility:

- Available at all Post Offices and authorized banks across India.

Atal Pension Yojana Scheme Details (Registration Form) at apy.nps-proteantech.in

Advantages of Senior Citizen Savings Scheme

- Financial Security: Provides a regular income stream for senior citizens.

- High Returns: Offers a competitive interest rate, higher than most fixed deposits.

- Flexibility: Premature withdrawal options ensure liquidity for emergencies.

- Tax Savings: Offers tax deductions under Section 80C.

Eligibility for Senior Citizen Savings Scheme

- Individuals aged 60 years or above can open an account.

- Individuals aged 55 years or above but below 60 years, who have retired under Superannuation, VRS, or Special VRS, are also eligible.

- Retired Defence Services personnel (excluding civilian employees) can open an account upon reaching the age of 50, subject to specified conditions.

How to Open an SCSS Account

Senior Citizen Savings Scheme account can be opened at any post office or authorized private or public sector bank in India. The process for both options is outlined below:

STEP 1: Visit the nearest Post Office or authorized bank branch.

STEP 2: Fill out the application form.

STEP 3: Provide necessary documents like:

- Age proof (Aadhaar, PAN, or birth certificate).

- Address proof.

- Deposit amount via cheque or demand draft.

STEP 4: Submit the form along with the initial deposit amount.

https://portalguide.in/tag/central-government-schemes/

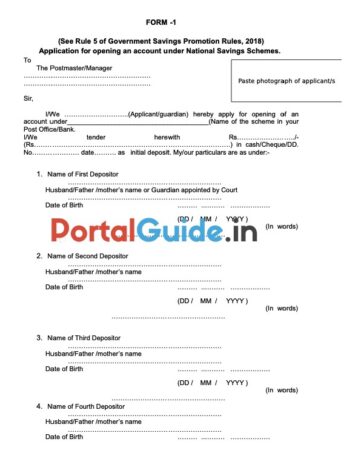

Post Office Senior Citizen Savings Scheme Application Form

The SCSS application form can be obtained from any Post Office branch or downloaded from the official Post Office website https://www.nsiindia.gov.in/(S(mn1deeetkj50geajb2l0ux45))/InternalPage.aspx?Id_Pk=38.

Follow these steps to complete the application form:

STEP 1: Write the name of the Post Office branch in the top-left corner of the form.

STEP 2: If you have a Post Office savings account, enter your account number.

STEP 3: Provide the Post Office branch address in the ‘To’ field.

STEP 4: Paste the account holder’s photograph in the designated space.

STEP 5: Enter the account holder’s name in the first blank field and select the ‘SCSS’ option from the drop-down menu.

STEP 6: Skip the ‘Additional Facilities Available’ section, as it applies only to savings account applications.

STEP 7: Select the type of account holder—self, minor with guardian, or person of unsound mind with guardian.

STEP 8: Specify whether the account will be single, either or survivor, or all or survivor.

STEP 9: In field 2, enter the deposit amount in both figures and words. If depositing via cheque, mention the cheque number and date.

STEP 10: Fill in the account holder’s personal details in the relevant fields.

STEP 11: Check the boxes to indicate which document proofs are submitted.

STEP 12: Ensure all account holders sign at the bottom of Page 1 and Page 2 of the form.

STEP 13: Mention the nominee’s name and contact information. Confirm this by including the signatures of all account holders.

List of Banks Offering the Senior Citizen Savings Scheme

- Union Bank of India SCSS

- ICICI Bank SCSS

- State Bank of India SCSS

- UCO Bank SCSS

- IDBI Bank

- Indian Bank

- Indian Overseas Bank SCSS

- Punjab National Bank SCSS

- Canara Bank

- Central Bank of India

- Bank of Maharashtra SCSS

- Bank of Baroda

- Bank of India SCSS